What is an ETF?

What is an ETF?

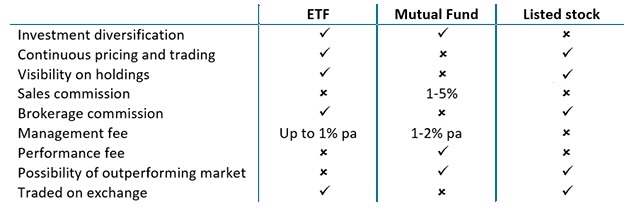

An exchange traded fund (ETF) is simply a mutual fund listed and traded on a stock exchange. ETFs combine the features of mutual funds with the trading characteristics and accessibility of listed stocks.

A traditional ‘active’ manager seeks to outperform a specific index (FTSE 100, MSCI emerging markets, QE Index, etc) by picking stocks expected to perform better than the index. ETFs are ‘passive’ investments which do not seek to outperform an index, but passively aim to track a specific index as closely as possible. ETFs therefore cost less, so are more efficient than mutual funds.

Combining the features of a mutual fund…

Investors who buy shares in an ETF become part-owners of pooled assets, similar to a mutual fund. While ETFs are also managed by professional investment managers who charge management fees, these are at reduced rates compared to actively managed mutual funds. Investors should certainly ensure they are paying lower fees for an ETF than for a mutual fund investing in a similar strategy. While fees should be lower, ETF investors must note that an ETF should not outperform a market, nor should it significantly underperform.

…with the characteristics and accessibility of a listed stock

However, in contrast to mutual funds, ETF shares are traded in continuous markets on stock exchanges, so can be bought and sold like shares in any other listed company. Also, unlike mutual funds, this allows investors to keep track of the value of their investment in real time and allows the immediate purchase or sale of their assets during trading hours.

ETFs compared to mutual funds and individual listed shares

What can an ETF invest in?

Today, ETFs provide liquid access to most asset classes such as equities, fixed income, commodities, currencies and real estate. It is also possible invest in leveraged and inverse ETFs (where the value of the ETF moves inversely to the performance of the underlying). This ease of access and flexibility is used by both small and large investors alike, at significantly lower fees than for a typical, professionally managed, mutual fund. While ETFs are not able to outperform their benchmark, they are a convenient way to broadly track it.